by JJ Mack | Nov 29, 2025 | Financing Strategies, Homebuyer Tips, Local Market Insights

Buying a home in today’s market is more competitive, more complex, and more fast-paced than ever. That’s why more buyers are turning to local experts to guide them through the process. Work with a Roseville mortgage lender to give you a major advantage — from faster...

by JJ Mack | Nov 24, 2025 | Financing Strategies, Homebuyer Tips, Local Market Insights

If you’re planning to buy a home in Roseville, one of the biggest factors affecting your budget is mortgage rates. Rates have moved rapidly over the past few years, and even small changes can dramatically shift how much home you can afford. As a local Roseville...

by JJ Mack | Nov 23, 2025 | Financing Strategies, Homebuyer Tips, Local Market Insights

If you’re planning to buy a home in Roseville in 2025, one of the most important questions you’re likely asking is: “What are the current mortgage rates in Roseville, and how do I get the best one?” Mortgage rates have changed dramatically over the past few years, and...

by JJ Mack | Nov 17, 2025 | Financing Strategies, Homebuyer Tips, Local Market Insights

When you’re buying a home in California—especially in competitive markets like Roseville, Rocklin, and Loomis—every bit of savings helps. One strategy many buyers overlook is purchasing mortgage points, a tool that can lower your interest rate and reduce your...

by JJ Mack | Nov 17, 2025 | Financing Strategies, Homebuyer Tips, Local Market Insights

Buying a home when you’re self-employed can feel overwhelming — especially in California, where lending rules are strict and income documentation is more complex. The good news? Thousands of self-employed buyers purchase homes across Roseville, Sacramento, and the...

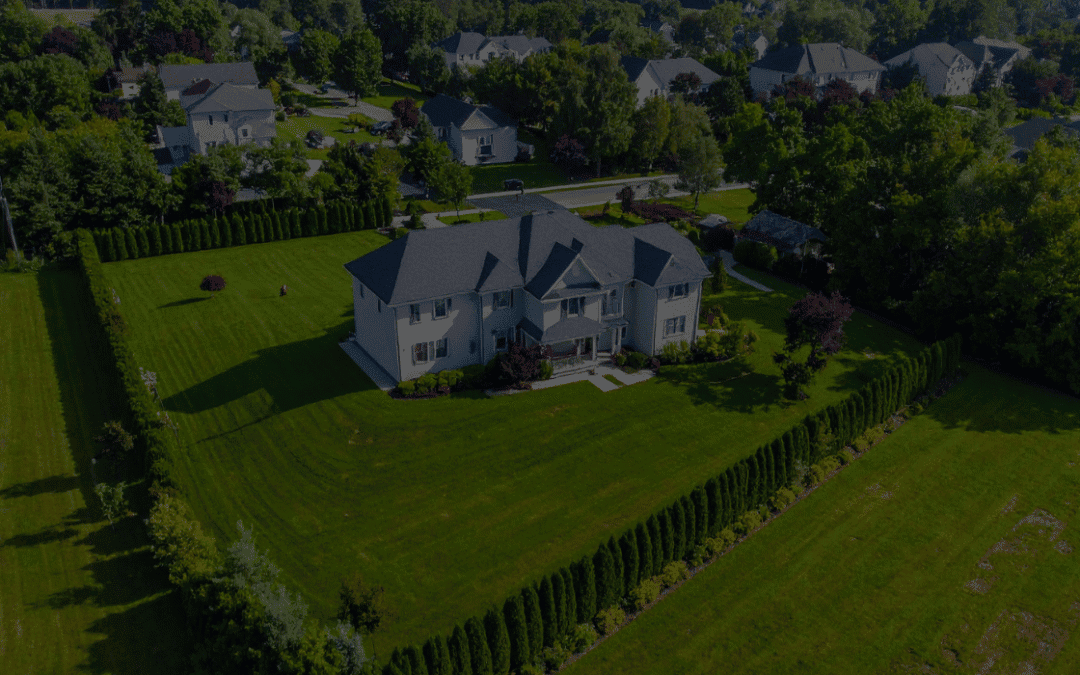

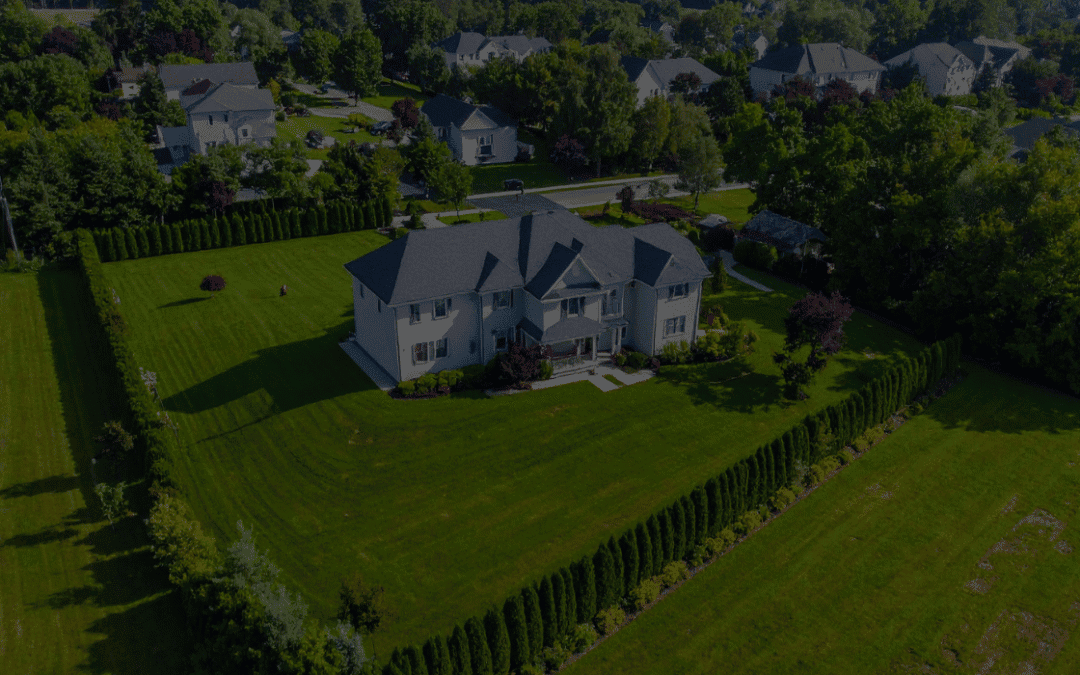

by JJ Mack | Nov 7, 2025 | Financing Strategies, Homebuyer Tips, Local Market Insights

Buying a home in Rocklin is a smart move for families and first-time buyers looking for strong schools, community amenities, and good value. Below are three of the best neighborhoods in Rocklin for families to consider — plus tips on what to look for and how to match...